You May Also Like

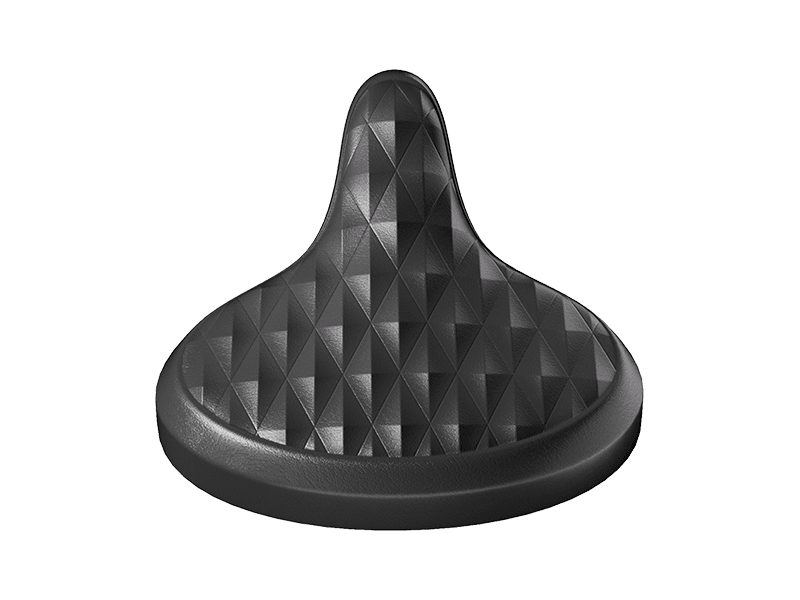

Oversized Comfortable Saddle

Twist Throttle with Grips (Right-Hand Only)

CRAVOT CyberRack E2 Hitch Bike Rack

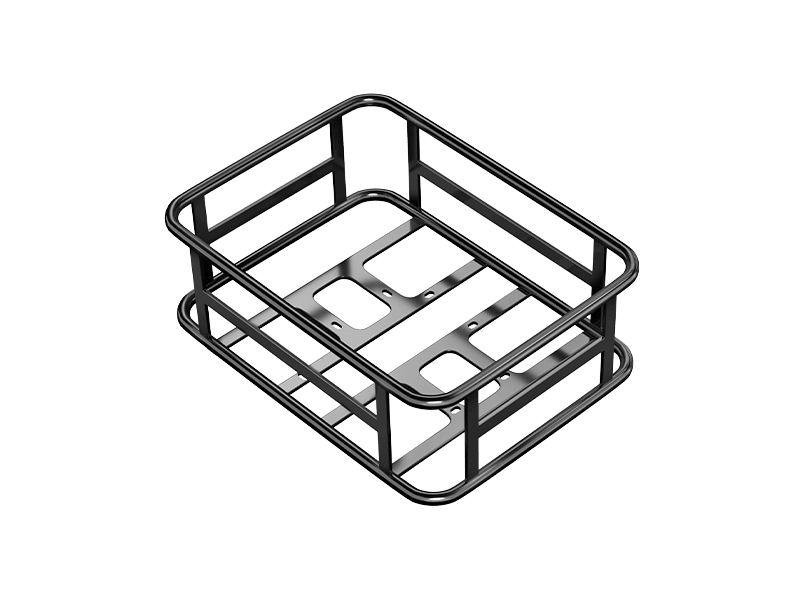

Rear Basket

Cycling Package (6-Piece Kit) - United States Only

Cycling Package (9-Piece Kit) - Canada Only

There's no item in your cart.

You May Also Like

You're Saving $0.00

Shipping, taxes, and discount codes calculated at checkout.

With Affirm, you’ll see your total cost upfront and know when your payments end.

Affirm shows you your total payment upfront, with no hidden fees.

Choose from available payment options that fit your budget.

Affirm does not charge late fees for Pay in 4, and there are no hidden fees..

ayment options through Affirm are subject to an eligibility check and may not be available in all states or for all purchase amounts. APR rates range from 0–36% based on your creditworthiness.

Affirm loans are issued by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC.

0% APR financing, where available, is subsidized by the merchant and cancellation fees may apply. See the payment page for details.

State notices to consumers and other important information are available at

affirm.com/licenses.

| Product Title |

| Price |

| Color |

| Frame Style |

| Mode |

| Power |

| Battery Capacity |

| Charging Time |

| Assist Speed |

| Range |

| Rider Height |

| Rear Derailleur |

| Front Fork |

| Motor |

| Sensor |

| Charger |

| Controller |

| Torque |

| Suspension |

| Display |

| Brakes |

| Tires |

| Seat Post |

| Bike Weight |